In order to implement the Opinions on Financial Support for Hainan's Comprehensive Deepening of Reform and Opening-up and to enhance the convenience of cross-border securities investment and foreign exchange settlement, the Hainan Branch of the People’s Bank of China (“PBOC”), in collaboration with the Hainan Office of the National Financial Regulatory Administration ("NFRA"), the Hainan Office of the China Securities Regulatory Commission ("CSRC"), the Hainan Provincial Local Financial Administration, and the Hainan Branch of the State Administration of Foreign Exchange, jointly issued the Implementation Rules for the Cross-Border Asset Management Pilot in Hainan Free Trade Port (the "Rules") on July 21, 2025, which will take effect on August 21, 2025.

The Hainan Free Trade Port Cross-Border Asset Management Pilot ("Hainan Cross-Border AM Pilot") represents a new route for foreign investors to access China's financial markets, following previous initiatives such as QFII (including RQFII), Stock Connect, CIBM Direct, Bond Connect, Mutual Recognition of Funds, Cross-Border Wealth Management Connect in the Greater Bay Area ("Cross-border WMC"), ETF Connect, Swap Connect and QFLP.

This article provides a brief overview of the core elements and key significance of the Hainan Cross-Border AM Pilot based on the contents of the Rules and the author’s long-term observation on China’s financial market opening.

- Core Elements of the Hainan Cross-Border AM Pilot

- Definition and Scope of the Pilot Business

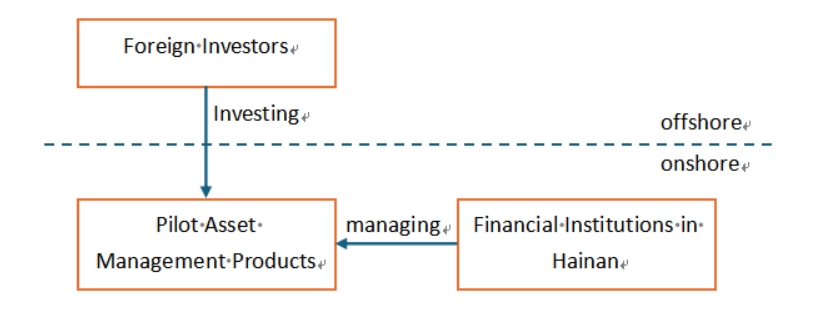

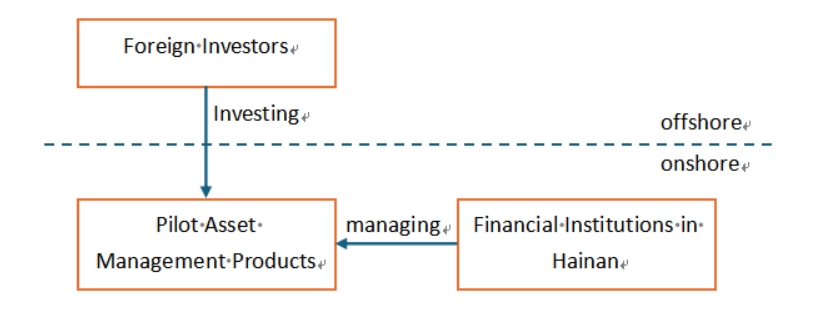

The Hainan Cross-Border AM Pilot allows eligible overseas investors to invest their lawful funds in RMB-denominated asset management products issued by financial institutions domiciled in the Hainan Free Trade Port, including:

|

#

|

Asset Management Product

|

Manager

|

|

1

|

wealth Management Products

|

wealth management companies established by commercial banks

|

|

2

|

private asset management products

|

securities and futures institutions (i.e., retail fund managers, securities companies, futures companies, and their asset management subsidiaries)

|

|

3

|

retail funds

|

retail fund managers

|

|

4

|

insurance asset management products

|

insurance asset management companies

|

|

5

|

Other asset management products recognized by CSRC and NFRA for participation in the pilot

|

/

|

The above-said asset management products shall invest in the domestic markets only.

- Types of Overseas Investors and Sources of Funds

- Overseas Investors: Refers to qualified overseas institutional and individual investors.

- Overseas Institutions: Lawfully established entities outside mainland China (including those domiciled in Hong Kong SAR, Macau SAR, and Taiwan Region), using funds sourced either domestically or abroad to purchase pilot asset management products.

- Overseas Individuals: Foreigners studying, working, or living in the Hainan Free Trade Port, or those classified as high-end or urgently needed foreign talents under Hainan's relevant policies, using funds sourced domestically (subject to verification) to purchase pilot asset management products.

- Phased Implementation

During the initial 180 days upon the commencement of the pilot, overseas institutional investors must be licensed financial institutions or lawful offshore entities of Chinese enterprises. Other overseas investors using overseas funds will not be accepted initially.

Subsequent expansion to other types of overseas institutional investors will require approval through prescribed procedures by the relevant national financial regulators.

- Investor Suitability

Overseas investors will be subject to the same suitability standards as domestic investors, including risk tolerance assessments. Distributors are required to uphold the "know your client" and "seller's duty of care" principles, and must avoid misleading distribution practices or promising returns. Enhanced disclosure and investor education obligations will apply.

Among the pilot asset management products, retail funds and private asset management products offered by securities and futures institutions must be categorized within risk levels R1 to R4.

- Participating Institutions and Regulatory Rules

Participating institutions ("Pilot Institutions") include:

- Pilot banks: Commercial banks within the Free Trade Port that open investment accounts (“Investment Accounts”) for overseas investors to facilitate purchases, redemptions, fund transfers, settlements, and foreign exchange services.

- Pilot managers: Licensed and compliant financial institutions registered in Hainan with qualifications to issue relevant asset management products.

- Distributors: Licensed financial institutions or their branches within the Free Trade Port authorized to sell the relevant asset management products.

All Pilot Institutions must file applications in advance with CSRC/NFRA and meet internal management, risk control, and investor protection requirements. Upon review, the CSRC/NFRA will issue written approval and will publicly disclose the list of Pilot Institutions on their official websites.

- Closed-Loop Fund Account Administration

Funds from overseas investors will operate through designated "Investment Accounts" with defined sources and uses to ensure traceability and monitorability of fundraising, investment, dividends, and redemptions. RMB settlement will be adopted in compliance with current cross-border account management regulations.

- Channel Services Forbidden

The managers shall effectively fulfill its active management responsibilities and shall not provide channel services for overseas institutions or individuals.

- Management of Investment Agreements and Related Documents

Distributors, after verifying overseas investor eligibility, must enter into standardized contracts for asset management products and, in addition, sign cross-border investment agreements with overseas investors either on-site or through legally compliant online channels.

Such agreements must clearly set out operational procedures, rights, and obligations of all parties, and must fully disclose information and risks to overseas investors.

- Aggregate Quota Management

The initial aggregate quota for the pilot is set at RMB 10 billion. Pilot managers must apply for quotas from the Hainan Branch of the PBOC. Quotas will be adjusted dynamically based on need to ensure orderly and stable progress and mitigate macro-level cross-border capital risks.

- Enhanced Investor Protection

It must adhere to the principle that the laws of the country/region where the act happens shall apply, with diversified dispute resolution mechanisms including complaints, mediation, arbitration, and litigation. Overseas investors will enjoy the same legal protections as domestic investors. Distributors must establish sound complaint-handling mechanisms.

- Significance of the Hainan Cross-Border AM Pilot

- Significantly Broadened Investment Scope

Existing connect schemes such as Stock Connect, Bond Connect, and Mutual Recognition of Funds offer relatively limited investment scopes. Although the investment scope of QFII has been expanded to include private asset management products and private securities investment funds in the past few years, their underlying investments remain subject to QFII regulations. The investment scope of Cross-border WMC is limited to retail funds and retail wealth management products etc.

In contrast, the allowed investment scope under the Hainan Cross-Border AM Pilot encompasses retail funds, private asset management products of securities and futures institutions, wealth management products and insurance asset management products, thus greatly broadening the range of permissible investments.

- Attracting Domestic and Foreign Financial Institutions to Establish a Presence in Hainan

Compared with such regions as Beijing, Shanghai, Guangzhou, and Shenzhen, Hainan has relatively much fewer financial institutions. With the progressive implementation of Free Trade Port policies, more financial institutions have been established in Hainan in recent years. For example, in 2024 and 2025, the first two retail fund managers were established in Hainan consecutively.

As the pilot limits managers of asset management products to financial institutions registered in Hainan, this policy is expected to attract both domestic and foreign financial institutions to establish an appropriate presence in Hainan.

- Another Regional Pilot Following Cross-border WMC

The Hainan Cross-Border AM Pilot differs from Cross-border WMC in certain respects. For example, it adopts a unilateral, proactive opening model and is open globally without regional limitations; in contrast, Cross-border WMC is based on bilateral agreements and mutual access, with the northbound link open only to investors from Hong Kong and Macau SAR.

Nonetheless, both pilots serve as regional initiatives exploring capital account liberalization, as support by central government. One in Hainan, and the other in the Greater Bay Area. These local and small-scale pilots provide valuable experience for China’s broader capital account policy reform.

- Observations and Outlook

The Hainan Cross-Border AM Pilot represents a major breakthrough in the opening of China’s financial and capital markets.

As a pilot policy, it allows various financial institutions—including securities and futures institutions, banks, wealth management companies, insurance asset management companies, and fund distributors—to participate in the pilot, making its significance far-reaching.

As far as we know, some Hainan-based financial institutions have already actively conducted policy research, feasibility studies, and preparatory work related to the pilot.

For updates on other recent financial opening policies, please refer to the China chapter, authored by us, in the International Asset Management and Investment Funds Review 2025/26 jointly published by Beaumont Capital Markets and the Alternative Investment Management Association (AIMA).

***

Author: Eric Zou (Partner)

eric.zou@promiseifa.com

Mobile: 150 2176 3268